Details

Pages

9 Pages

Subject

Math, Money, Business

Product

Digital

Grade

5th, 6th, 7th, 8th, 9th

Resource Type

Activities, Games, Lesson Plans

Description

Grade Levels | 5th - 9th, Homeschool

Subjects | Applied Math, Other (Math), Business

Resource Type | Activities, Games

Formats Included | PDF

Pages | 9 pages

This is a real-life lesson that encourages students to evaluate taxable income based on one's income and the marginal tax bracket. Kids will love this and have a great time discussing the occupations and how much each is taxed. This lesson does not go as far as to discuss personal deductions and standard deductions, which would lower your taxable income. That is for another day. This is a simple introduction to how Federal taxes are collected.

Focuses on taxable Income, understanding taxes, calculating taxes

Easel Activity Included

OBJECTIVE

o The learner will be able to calculate taxable income based on tax brackets, which are based upon percentages.

o The learner will understand the purpose of taxation and the difference between state tax and federal tax.

MATERIALS

o Occupation Game Cards (1 set of 24 per group) and Chart (1 per student)

PREPARATION

o Set up the classroom desks or tables so that students are sitting in groups of two or three.

INTRODUCTION: (20 minutes)

Ask students:

Available with purchase

GAME INSTRUCTIONS

Divide students into groups of two or three. Each group will receive a set of Occupation Game Cards. It is suggested that you laminate the cards, cut them, and place them in Zip Lock bags so they can be used every year.

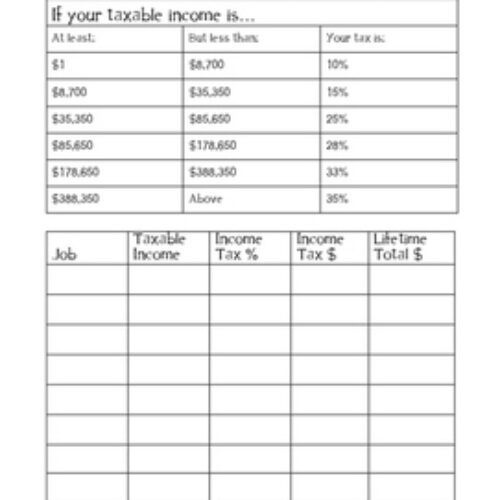

Students will be directed to place all cards face down. Distribute the Marginal Tax Bracket Chart.

Students within the group will take turns turning over an Occupation Game Card. Each will write the occupation, taxable income, and income tax percent using the Marginal Tax Bracket Chart provided on each student's activity sheet (see below). Students will work together to calculate the income tax and lifetime total.

Alternative: you may have students compete against those within their team as another way to play, rather than having one group compete against the other groups in the class. Whatever works best for your students and classroom environment is the best route to take.

The goal is to reach a lifetime total of 100,000 taxable incomes to win. This will require multiple games, or to make it more challenging, raise the Lifetime taxable income goal to 150,000 or 200,000, which will make the game run longer.

Students can create charts on notebook paper for additional games.

Once they reach the lifetime goal, they win that round. Then have them play again.

...............................................................................................................................

Permissions are given to the purchaser to make modifications to the game board using the Word document provided in the zip file. No other modifications may be made to this document.

................................................................................................................................

Customer Tips:

When do I post new products? Throw sales? Be the first to know:

• Click the green star next to my picture to become my newest follower.

How to get TPT credit to use on future purchases:

• Go under 'My TPT", and click on 'My Purchases". Then, click the provide feedback button next to your purchase. Every time you leave feedback on a purchase, TPT gives you credits that you can use to save money on future purchases. I value your feedback as it helps me determine what types of new products I should create for you and other buyers.

................................................................................................................................

© Martha Boykin Products. All rights reserved. Purchase of this product grants the purchaser the right to reproduce pages for classroom use only. If you are not the original purchaser, please download the item from my store before making copies. Copying, editing, selling, redistributing, or posting any part of this product on the internet is strictly forbidden. Violations are subject to the penalties of the Digital Millennium Copyright Act.

................................................................................................................................

Total Pages | 9 pages

Answer Key | N/A

Teaching Duration | 1 hour

REVIEWS

Highly Satisfied ⭐️⭐️⭐️⭐️⭐️

Great resource!

Highly Satisfied ⭐️⭐️⭐️⭐️⭐️

Wonderful! Thank you!

Highly Satisfied ⭐️⭐️⭐️⭐️⭐️

Used it without the game part and it still worked great!

Subjects | Applied Math, Other (Math), Business

Resource Type | Activities, Games

Formats Included | PDF

Pages | 9 pages

This is a real-life lesson that encourages students to evaluate taxable income based on one's income and the marginal tax bracket. Kids will love this and have a great time discussing the occupations and how much each is taxed. This lesson does not go as far as to discuss personal deductions and standard deductions, which would lower your taxable income. That is for another day. This is a simple introduction to how Federal taxes are collected.

Focuses on taxable Income, understanding taxes, calculating taxes

Easel Activity Included

OBJECTIVE

o The learner will be able to calculate taxable income based on tax brackets, which are based upon percentages.

o The learner will understand the purpose of taxation and the difference between state tax and federal tax.

MATERIALS

o Occupation Game Cards (1 set of 24 per group) and Chart (1 per student)

PREPARATION

o Set up the classroom desks or tables so that students are sitting in groups of two or three.

INTRODUCTION: (20 minutes)

Ask students:

Available with purchase

GAME INSTRUCTIONS

Divide students into groups of two or three. Each group will receive a set of Occupation Game Cards. It is suggested that you laminate the cards, cut them, and place them in Zip Lock bags so they can be used every year.

Students will be directed to place all cards face down. Distribute the Marginal Tax Bracket Chart.

Students within the group will take turns turning over an Occupation Game Card. Each will write the occupation, taxable income, and income tax percent using the Marginal Tax Bracket Chart provided on each student's activity sheet (see below). Students will work together to calculate the income tax and lifetime total.

Alternative: you may have students compete against those within their team as another way to play, rather than having one group compete against the other groups in the class. Whatever works best for your students and classroom environment is the best route to take.

The goal is to reach a lifetime total of 100,000 taxable incomes to win. This will require multiple games, or to make it more challenging, raise the Lifetime taxable income goal to 150,000 or 200,000, which will make the game run longer.

Students can create charts on notebook paper for additional games.

Once they reach the lifetime goal, they win that round. Then have them play again.

...............................................................................................................................

Permissions are given to the purchaser to make modifications to the game board using the Word document provided in the zip file. No other modifications may be made to this document.

................................................................................................................................

Customer Tips:

When do I post new products? Throw sales? Be the first to know:

• Click the green star next to my picture to become my newest follower.

How to get TPT credit to use on future purchases:

• Go under 'My TPT", and click on 'My Purchases". Then, click the provide feedback button next to your purchase. Every time you leave feedback on a purchase, TPT gives you credits that you can use to save money on future purchases. I value your feedback as it helps me determine what types of new products I should create for you and other buyers.

................................................................................................................................

© Martha Boykin Products. All rights reserved. Purchase of this product grants the purchaser the right to reproduce pages for classroom use only. If you are not the original purchaser, please download the item from my store before making copies. Copying, editing, selling, redistributing, or posting any part of this product on the internet is strictly forbidden. Violations are subject to the penalties of the Digital Millennium Copyright Act.

................................................................................................................................

Total Pages | 9 pages

Answer Key | N/A

Teaching Duration | 1 hour

REVIEWS

Highly Satisfied ⭐️⭐️⭐️⭐️⭐️

Great resource!

Highly Satisfied ⭐️⭐️⭐️⭐️⭐️

Wonderful! Thank you!

Highly Satisfied ⭐️⭐️⭐️⭐️⭐️

Used it without the game part and it still worked great!

Grade Levels | 5th - 9th, Homeschool Subjects | Applied Math, Other (Math), Business Resource Type | Activities, Games Formats Included | PDF Pages | 9 pages This is a real-life lesson that encourages students to evaluate taxable income based... more